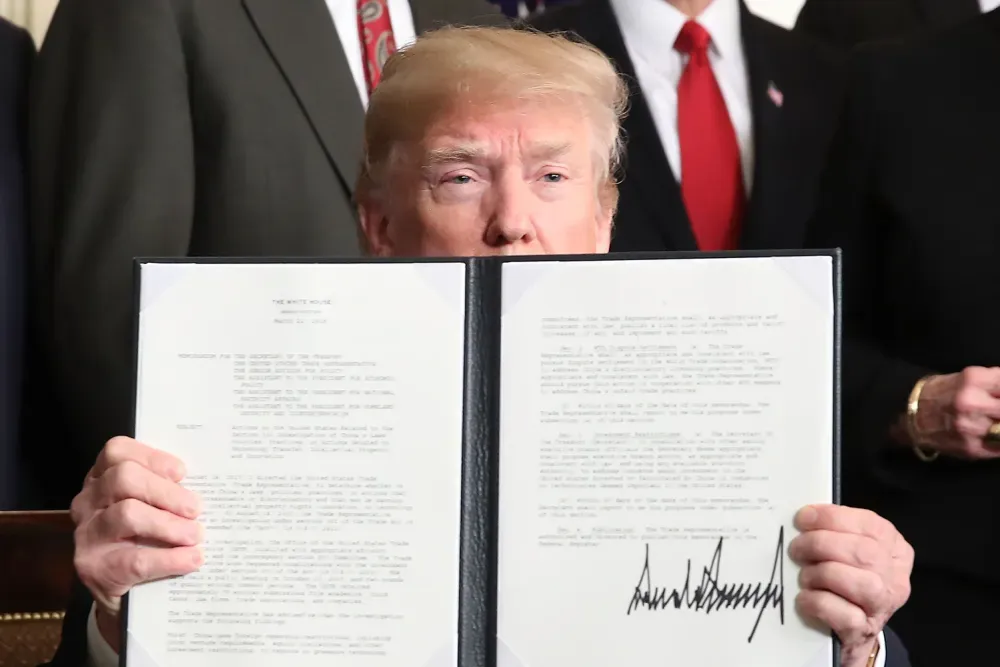

Trade tariffs have played a significant role in shaping the relationship between the United States and China. During President Trump's administration, Section 301 tariffs of the Trade Act of 1974 were imposed to address concerns about unfair trade practices, including China's intellectual property theft and technology replication. These tariffs targeted a wide range of Chinese products, including electronics, machinery, and consumer goods. In response, China imposed tariffs on U.S. goods, including agricultural products, automobiles, and energy products, aiming to exert economic pressure on the U.S. Since their implementation, these tariffs have had severe financial consequences for both countries, affecting industries and consumers. The tariffs have created additional strain on the trade relationship, contributing to further economic distancing between two of the world's largest economies.

The Current Glide Path

Harvard political scientist Graham Allison introduced the concept of the Thucydides Trap to describe the security risks associated with a rising power challenging an established one. This model is particularly relevant to the U.S.-China relationship today, as China’s rapid economic ascent increasingly threatens the U.S.’s global dominance. In his analysis of 16 historical case studies over five centuries, Allison found that 12 of these power shifts led to war, highlighting the risks and complexities in managing Sino-American tensions. The causes in these cases ranged from accidents and unforced errors to unintended consequences of unavoidable choices. However, the optimistic takeaway is that four cases resulted in de-escalation, thanks to imaginative statecraft between the two nations. China and the U.S. share a pre-established diplomatic framework from the Nixon era, which requires reworking amid modern tensions.

Tariffs and China

According to economists from the Federal Reserve and leading research institutions, in the first year following the tariffs, the U.S. saw an estimated monthly reduction of $1.4 billion in real income. This reduction stemmed from higher business costs tied to the trade interdependencies with China, America’s largest trading partner. Additionally, many U.S. firms struggled to find viable alternatives to Chinese goods, underscoring the challenges posed by globally interdependent supply chains. Some U.S. exporters reported that retaliatory tariffs made markets outside the U.S. more attractive, eroding the U.S.'s share in the global market.

Several firms pointed out that the tariff actions did not eliminate China's practices or intellectual property theft criteria; rather, businesses suggested that the tariffs could have been targeted more effectively. Some argue the tariffs took away the ability of U.S. companies to make risk-based decisions of their own by placing a blanket policy over an interdependent market. Blazer Brand, a small Pennsylvania business, used a blend of Chinese-made and American-made molds. As the patent holders, the company stated they decided to safeguard intellectual property and argued that they could assess the risk independently in a more effective approach. Under the tariffs, they are now cut out of the decision-making loop and forced to find replacement products elsewhere.

Looking at how these tariffs have rattled both economies, it's time for a smarter approach. Instead of casting a wide net that snags everything from soybeans to steel, America might do better zeroing in on what really matters for national security – things like advanced computer chips. Broad-brush tariffs on everyday goods? That's using a sledgehammer when maybe we need a scalpel.

But here's the thing – any rollback of tariffs needs to be part of a bigger conversation. Take what we've learned from these tariffs: they've created a mixed bag of winners and losers across America. While factory workers in some towns are clocking more hours, farmers in others are feeling the squeeze. It's like reshuffling a deck – some got dealt better hands than before, others are still trying to make their new cards work.

This is why any new trade deal needs to thread the needle carefully. Yes, dropping tariffs could pump fresh life into both economies, but we've got to be smart about it. We're not just talking about two countries signing some papers – we're talking about millions of jobs, thousands of communities, and everything from steel mills to tech startups hanging in the balance. In this high-stakes game between the world's economic heavyweights, every move needs to count.

Regional Winners and Losers

The trade war with China has hit American communities in wildly different ways, creating a patchwork of economic winners and losers across the country. Look beyond the national headlines, and you'll find some regions discovering silver linings while others scramble to stay afloat.

The Midwest's farmers took the first big hit. Iowa tells the story: their powerhouse soybean trade with China – worth a cool $14 billion a year – crumbled by more than 75% when Beijing struck back with tariffs. Local farmers faced a brutal choice: sit on their harvest or sell at rock-bottom prices. The pain spread through small towns as farmers put off buying new equipment and tightened their belts.

But flip the coin, and you'll find some surprising success stories. In the rust belt, Ohio's steel mills roared back to life under the shelter of tariffs, adding jobs and firing up production. Yet this comeback came with a catch – local manufacturers using that same steel watched their costs soar, showing how even a single state can have both winners and losers.

The coasts tell their own tale. Silicon Valley tech firms wrestled with broken supply chains and pricier parts, forcing a hard look at their reliance on Chinese factories. California's wine country, which had been raising a glass to growing Chinese sales, watched exports drop 30% as Chinese wine lovers switched to Australian and Chilean bottles. West Coast ports saw fewer containers rolling through, hitting local warehouse and shipping jobs. Texas, though, showed how to roll with the punches. With its mix of energy, tech, and farming, the Lone Star State proved surprisingly nimble. When Chinese energy buyers backed away, Texas sellers found new customers across Asia. The state's ports didn't miss a beat, shifting focus to handle more trade with Southeast Asian countries to make up for the China slowdown.

State governments aren't sitting idle. Some launched programs helping businesses find new suppliers or crack new markets. Others poured money into job training to help industries break free from Chinese dependence. Take Pennsylvania – they set up a special program to help small manufacturers weather the trade storm.

This reshaping of local economies shows how Washington's trade moves can play out very differently on Main Street. While some regions have found their footing in this new reality, others are still searching for their path forward. It's a stark reminder that in a country as economically diverse as America, one-size-fits-all trade policies rarely fit all.

Beyond Tariffs: The Hidden Costs of Economic Decoupling

The trade war between Washington and Beijing has blown open a far bigger story: the great economic divorce between America and China. After years of tight economic partnership, these giants are pulling apart – and it's sending shockwaves through Asia and beyond.

Take Japan and South Korea. Long-time U.S. military allies but deeply invested in Chinese trade, they're now playing both sides more carefully. They haven't made a big show of it, but they're quietly setting up shop in places like Vietnam and Indonesia – a strategy they call "China+1." It's smart business, sure, but it's also about not keeping all their eggs in China's basket, especially after seeing Beijing use trade as a political weapon before.

Southeast Asia finds itself in an interesting spot – both winner and referee in this shake-up. Vietnam and Malaysia are watching foreign investment pour in as companies look beyond China. But it's complicated: these countries are under growing pressure to pick sides on everything from 5G networks to computer chip rules.

India's story is particularly fascinating. Despite its history of staying neutral in global power games, it's now positioning itself as the next big manufacturing hub, especially for electronics and medicine. The government's putting serious money behind this – $26 billion in manufacturing incentives across 13 industries. But matching China's manufacturing muscle? That's still a tall order, given India's infrastructure gaps and red tape.

There's also a scramble for vital materials – the rare earth elements needed for everything from Tesla's latest models to military hardware. China processes 80% of the world's supply, which has America and its allies racing to build alternative supply chains. Australia, sitting on a treasure trove of these minerals, has become a crucial partner, though building processing plants takes serious time and money.

But the biggest shift might be in how we think about globalization itself. The old idea that trading partners don't fight each other? That's being questioned. Instead, we're seeing a new world order where security concerns and trusted allies matter more than finding the cheapest deal.

This reshaping of global trade is changing how we innovate and develop technology. As supply chains split along political lines, creating cutting-edge tech gets more expensive and complex. Look at computer chips: China's pushing for self-sufficiency while America and its allies pour money into staying ahead through programs like the CHIPS Act.

The real test will be keeping this economic divorce from turning into a full-blown cold war. Finding the sweet spot between legitimate security worries and healthy trade will take some masterful diplomacy. And as the U.S. and China continue their strategic rivalry, how other countries navigate this divide will shape the global economy for generations.

Discussion